FTX crypto contagion continues after BlockFi bankruptcy

Content

DEXs are best for investors looking to switch from one digital asset to another and not well suited for someone looking to buy or sell digital assets with fiat currency, called on and off-ramping. It makes them less convenient for users that do not already hold cryptocurrencies. Users of decentralized exchanges must remember the keys and passwords to their crypto wallets, or their assets are lost forever and cannot be recovered. They require the user to learn and get familiar with the platform and the process, unlike centralized exchanges, which offer a more convenient and user-friendly process. Due to their nature of allowing for the peer-to-peer exchange of cryptocurrencies, decentralized exchanges prevent market manipulation, protecting users from fake trading and wash trading. These decentralized exchanges rely on smart contracts, self-executing pieces of code on a blockchain.

Secondly, it helps verify a person’s identity and credibility. A key thing to understand is that one crypto exchange can be very different from another. Some exchanges allow their users to store fiat and cryptocurrencies on the exchange, while some do not. Regardless of the exchange you choose, it’s a good idea to keep the large majority of how to become a cryptocurrency broker your digital assets in an offline storage service like a cold wallet, which is often even an option for staked coins. Exchanges should do the same with their assets that aren’t required forliquidity. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

How to Add Binance Smart Chain to Metamask

The Bitfront cryptocurrency exchange, which is owned by Line, formally declared on November 27 that it would shut down altogether by March 2023. The statement claims that additional problems in the bitcoin business as well as the ongoing bear market in cryptocurrencies were the main reasons for the shutdown. On the other hand, you can look for a crypto broker since they can provide traders with derivatives products, allowing them to engage in contracts to trade on the value of cryptocurrencies.

Among the 18,000-plus cryptocurrencies in existence, Bitcoin and Ethereum are the two largest cryptocurrencies by market capitalization. Bitcoin, the original and largest cryptocurrency, was developed in 2009 as an alternative monetary asset. It was meant to be an alternative to the U.S. dollar and other fiat currencies. Although some vendors may accept Bitcoin as payment, most investors view it as a speculative investment.

Until the 2022 Union Budget announcement, the fate of cryptocurrency in India was largely undecided. Plus, it is easy to see how simple speculations over the internet can result in a substantial rise or loss of value of these coins. There are many advantages to dealing in cryptocurrencies, and a fair share of disadvantages as well. Here are the top three reasons that work in favor of and against cryptocurrencies. Cryptography is the method that secures data from unauthorized access by the use of encryption techniques.

Centralized exchanges:

The exchange has scaled back some of its operations in recent years, and in August 2021, South Korean services was discontinued. Since you are looking for a crypto exchange, you should evaluate the number of cryptocurrencies and currency pairs the crypto exchange offers. It set off the debate on whether or not the tax on cryptocurrency indicates the government has recognized it as a legitimate form of currency. Bitcoin is the world’s first widely accepted form of cryptocurrency.

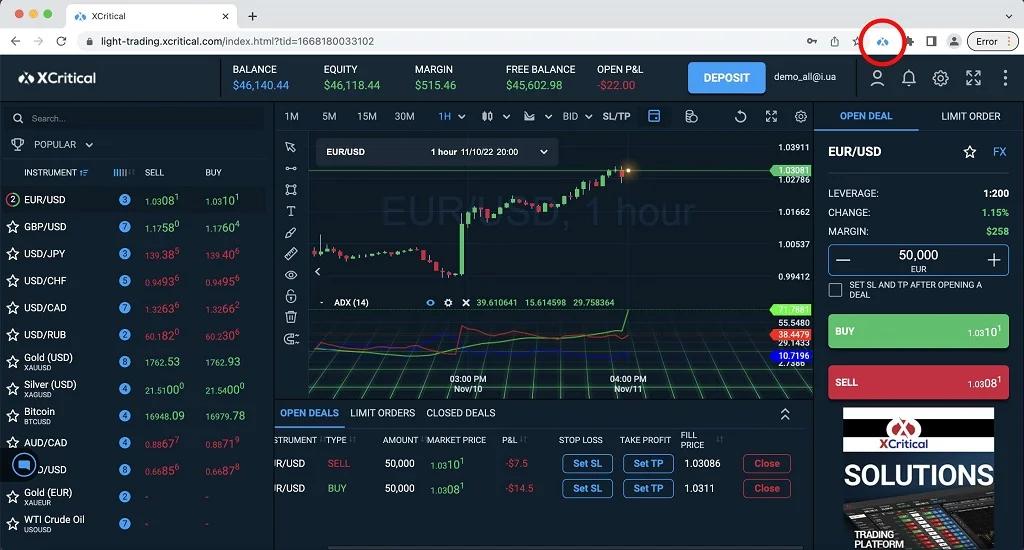

As of today, the two most popular ways are cryptocurrency exchanges and cryptocurrency brokerages. Crypto brokerage enables indirect trading by moderating between customers and the market. A crypto exchange also serves as an intermediary, but exclusively between traders. Crypto exchanges work similarly to a broker, giving you the tools to buy and sell cryptocurrencies easily.

And as always, don’t invest more than you can afford to lose. Once bought, cryptocurrencies can be stored in digital wallets. Hot means the wallet is connected to the internet, which makes it easy to transact, but vulnerable to thefts and frauds. Cold storage, on the other hand, is safer but makes it harder to transact. Exchanges are very vulnerable for hacks, because there is simply a lot of money available to steal. The question remains whether these exchanges have enough liquidity to pay back the lost funds to their users.

What is a decentralised cryptocurrency exchange?

Investors will need to evaluate where and how to transact in cryptocurrencies, and whether staking tokens—a way of earning rewards or interest for holding certain cryptocurrencies—is worth it. That means deciding to trade on a crypto exchange, and learning how you will use it. Unlike centralized ones, decentralized exchange or DEX are indeed closer towards the true spirit of cryptocurrencies, with no third-party or intermediary being involved in its financial operations. And being an open-source platform where users rely on peer-to-peer transactions, transaction fees and processing times would be much lower. Cryptocurrency exchanges are primarily categorized into centralized and decentralized exchanges, with another being hybrid cryptocurrency exchanges. Let’s run down all three forms of exchanges and understand how they stack against.

With a simple platform, KuCoin makes trading pretty straightforward, which can be great for beginners, with additional features that also make it ideal for more experienced users. Many investors opt to use cryptocurrency exchanges due to their relatively low trading fees. However, keep in mind that some platforms might not be beginner-friendly, tending to overwhelm users, particularly those who are not familiar with trading stocks.

- The Bitfront cryptocurrency exchange, which is owned by Line, formally declared on November 27 that it would shut down altogether by March 2023.

- There aredifferent exchange rates for different exchange platforms.

- In these exchanges, a buyer is matched with a seller, and they exchange currency at their own agreements.

- In these exchanges, you can buy cryptocurrencies from brokers directly.

- Kraken is a Delaware-based company that stands as the tenth largest crypto exchange in trading volume, according to CoinMarketCap, in a list topped by Binance.

While BlockFi’s exposure to FTX dragged it into bankruptcy, it may not have featured similar failures of corporate controls that FTX had. According to documents filed with the bankruptcy court, Valar Ventures, which is backed partly by the tech mogul Peter Thiel, owns 19 percent of BlockFi. A spokesman for Mr. Thiel did not immediately respond to a request for comment. On Monday, BlockFi, which was founded in 2017, filed for Chapter 11 protection in New Jersey. Its implosion is the latest example of an industry built on shaky foundations, with companies so intertwined that a single wobble can unleash financial chaos. In short, Ethereum is a massive digital ecosystem through which digital information and computer applications can be transported, stored, and even created.

Decentralized

However, it’s best to start with the most crucial tip of all Don’t trade with money you can’t afford to lose. It’s easy to get caught up in the earning potential- fast returns and quick profits- but one can get swept away in a matter of seconds. Never borrow money to invest in crypto, and take only as big a risk as you can bear without burning a massive hole in your pocket. Type ‘cryptocurrency exchange’ into your search engine and a host of companies — all cleverly named and with a unique business proposition — quickly appears. But like we hear from experts time and again when it comes to crypto, taking the time to learn as much as you can before you put money into crypto is one of the most useful things you can do.

Centralized exchanges offer an extra layer of security and reliability when it comes to transactions and trading. By facilitating the transaction through a developed, centralized platform, centralized exchanges offer higher levels of comfort. A decentralized exchange is another type of exchange that allows peer-to-peer transactions directly from your digital wallet without going through an intermediary. Examples of DEXs include Uniswap, PancakeSwap, dYdX, and Kyber. One of the biggest reasons for choosing to use cryptocurrency is its security, so picking a secure platform is just as important to keep your money safe.

The denomination of funds kept in DCP accounts may be of a real or fictitious currency. A hybrid cryptocurrency exchange is a combination – as the name implies – of both centralized and decentralized exchanges. Taking the best from platform concepts, a hybrid exchange offers the trustless nature combined with the low latency and fast transaction speeds of centralized platforms. Most cryptocurrency exchanges provide their own crypto wallets for users, contributing to a better user experience.

More advanced exchanges require valid authentication, particularly those that operate with fiat currency. Be prepared that someone from the crypto exchange will require you to have a video chat or take a picture of you holding your ID. In addition, a full KYC procedure must be completed, particularly if a trader wishes to make a large deposit. Now that you have more detailed information about crypto brokerages and crypto exchanges, it is time to find out the main differences between them in the following section. Numerous crypto exchanges introduce assets that may reduce trading costs.

Centralized vs. Decentralized vs. Hybrid Cryptocurrency Exchanges

In 2006, U.S.-based digital currency exchange business Gold Age Inc., a New York state business, was shut down by the U.S. Customers provided limited identity documentation, and could transfer funds to anyone worldwide, with fees sometimes exceeding $100,000. Some brokerages which also focus on other assets such as stocks, like Robinhood and eToro, let users purchase but not withdraw cryptocurrencies to cryptocurrency wallets. Dedicated cryptocurrency exchanges such as Binance and Coinbase do allow cryptocurrency withdrawals, however. A decentralized exchange – also referred to as a DEX – acts as an alternative to a traditional, centralized exchange. This type of cryptocurrency platform does not depend on a company or a service to control the assets of a customer.

Some crypto exchanges accept a bank transfer, credit or debit card, currency contracts, or even gift vouchers. Offering cryptocurrency or cryptocurrency pairing at this point reflects well for the centralized exchange, as it https://xcritical.com/ allows customers to transact for ether tokens. Fewer exchanges sell fiat currency / crypto-currency pairs, which would make, say, USD exchanges for bitcoin. There aredifferent exchange rates for different exchange platforms.

What to Look for in an Exchange

Investopedia does not include all offers available in the marketplace. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Follow these steps to find the proper exchange for your investing needs.

Decentralized exchanges:

Every transaction that uses its services is subject to a fixed commission or fee. Coinbase, for example, offers rewards for learning about new coins through its Coinbase Earn program. In exchange for watching videos and completing quizzes related to different coins, Coinbase will reward you with a small portion of the crypto, which you can then hold or convert to something else. Others offer courses and articles on site to help you learn about crypto markets, history, and innovations, such as Gemini’s Cryptopedia or Binance Academy from Binance. CoinMarketCap, a price-tracking site for cryptocurrencies, continually tracks the trade volume of hundreds of exchanges in operation.

First, you need to buy a cryptocurrency on a fiat-crypto exchange and then transfer it to the wallet of the crypto-crypto exchange. After that, you can trade for the coin which you want to buy in the first place. Just remember, these types of coins are often even riskier gambles on top of already highly speculative, more established cryptocurrencies. That’s why many experts recommend sticking with the big names like Bitcoin and Ethereum. With any crypto coin you’re considering buying on an exchange, only trade in a cash value you’re prepared to lose.